What a Fractional CFO Actually Implements

From forecasting tools to internal controls, this article explores the systems that turn finance from a reporting function into a strategic asset—starting within the first 90 days.

The Strategic Inflection Point: When a Business Truly Needs a Fractional CFO

Even fast-growing businesses hit a point where instinct and accounting no longer provide clarity. This article explores when and why a Fractional CFO becomes essential for confident, forward-looking decisions.

The 2026 Real Estate CFO Playbook - Mastering Cash Flow in a High-Rate Market

Mastering cash flow in a high-rate market requires more than tracking NOI. The 2026 Real Estate CFO Playbook explores dynamic forecasting, portfolio restructuring, operational efficiency, and investor transparency strategies that help real estate operators protect liquidity and drive long-term value.

Optimizing Labor Cost Management in the Hospitality Sector: A Comprehensive Guide

Learn how hospitality businesses can optimize labor cost management through accurate forecasting, technology, data analytics, and employee engagement to improve efficiency, reduce expenses, and protect profit margins.

Real-Time Financial Visibility in Hospitality Finance

Hospitality margins are under pressure from labor volatility, food cost compression, and delivery platform economics. Discover why real-time financial visibility is becoming essential for protecting cash flow, controlling costs, and sustaining profitability in hospitality finance.

Unraveling the Delivery Platform Illusion in Hospitality Finance

Delivery platforms can inflate hospitality revenue while quietly constricting cash flow. Learn how commissions, payment delays, and margin compression create the “Delivery Platform Illusion” and what financial leaders can do to protect liquidity and long-term profitability.

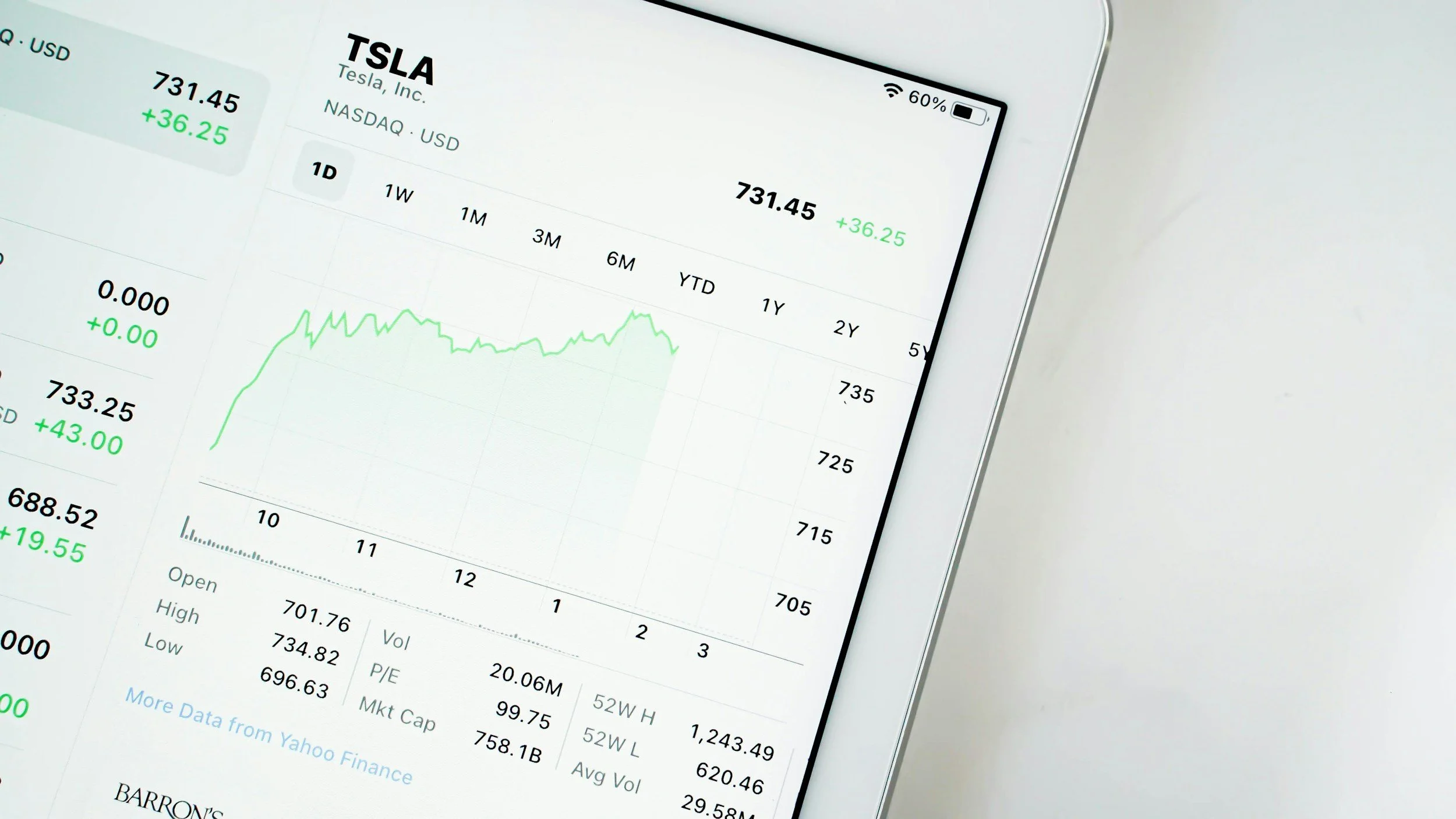

When AI Starts Buying: What It Means for E-commerce Cash Flow

As AI begins making autonomous purchasing decisions, e-commerce cash flow is shifting. Explore how AI-driven demand, inventory precision, and real-time financial visibility are reshaping working capital strategy and the evolving role of CFO leadership.

The Hidden Cost of Decision Latency in Growing Companies

Decision latency quietly erodes growth and margins in scaling companies. Learn how delayed financial decisions impact performance and why structured leadership reduces decision lag.

Unraveling the Complex World of Global Finance

Global payment complexity creates hidden risk in liquidity, compliance, and treasury management. Learn how Part-Time CFOs bring structured oversight and financial clarity to international operations.

Embracing the On-Demand CFO Model for Financial Leadership

Discover how the On-Demand CFO model is redefining financial leadership for modern businesses. Learn how flexible, AI-driven fractional CFO engagement strengthens forecasting, cash flow discipline, and strategic agility without adding full-time executive overhead.

Why Margin Leakage Persists Even in Well-Run Companies

Margin leakage can quietly erode profitability even in well-run companies. Learn why visibility gaps, timing delays, and fragmented ownership allow margin erosion to persist, and how finance teams can address it before growth slows.

The Crucial Intersection of Financial Models and Strategic Decisions

Financial models don’t create clarity on their own. Their value depends on the quality of the decisions they inform. This article explores how financial leadership, context, and judgment turn models into tools that support confident, strategic decision-making.

The Unpredictable World of E-commerce Forecasting

E-commerce forecasts break when volatility, shifting consumer behavior, and outdated assumptions collide. Understanding why plans fail and how finance teams recalibrate is key to maintaining control and sustainable growth.

The Embedded Finance Revolution in E-commerce

In e-commerce, cash flow and working capital pressures often show up in subtle ways. Delays in payouts, inventory timing, and access to short-term capital can quietly limit how a business operates and grows. Embedded finance is beginning to change that dynamic by bringing financial tools directly into the platforms e-commerce teams already use.

Unlocking the Secrets of the E-commerce Cash Conversion Cycle

The e-commerce cash conversion cycle often determines liquidity long before revenue tells the full story. Understanding how inventory timing, receivables, and payables interact gives founders the visibility needed to protect cash flow and support sustainable growth.

The Future of Finance with AI and Machine Learning

AI and machine learning are moving finance beyond automation into real-time insight and foresight. From accounting and operations to CFO decision-making and tax strategy, these technologies are reshaping how financial leaders manage risk, efficiency, and growth.

CFO Guide to Sustainable Growth in E-commerce and Finance

The role of the CFO in e-commerce has expanded far beyond reporting. Sustainable growth today depends on how finance leaders connect technology, operations, tax strategy, and collaboration into a single, forward-looking approach.

Why Profitable E-commerce Brands Face Cash Flow Challenges

Profitability doesn’t always translate into liquidity for e-commerce brands. Timing gaps between revenue, inventory, marketing spend, and cash receipts often create pressure long before it shows up in the numbers.

The Relentless Pace of Tech Startups

Speed accelerates growth in tech startups, but it also compresses the margin for financial error. When execution outpaces financial visibility, risk compounds quietly.

From Funding to Flourishing for Tech Startups

Raising capital is only the beginning. What determines whether a tech startup truly flourishes is how well financial leadership, systems, and strategy evolve after the funding lands.